Decentralized autonomous organizations, or DAOs, create decentralized solutions for problems that have typically been solved via rigid, centralized mechanisms. With the advent and later mass adoption of blockchain, decentralized mechanisms of financial transactions, voting, etc., have been recognized by several corporations and nations.

Organizations like Kaddex have been at the forefront of developing decentralized solutions that are suitable for mass adoption. Organizations like Kaddex have entered the world of blockchain to create a host of products that allow decentralized proof of identity, decentralized verification systems, etc.

Ways In Which Decentralized Financial Solutions Are Changing The World

1. Solutions That Allow Digital Ownership Of Assets

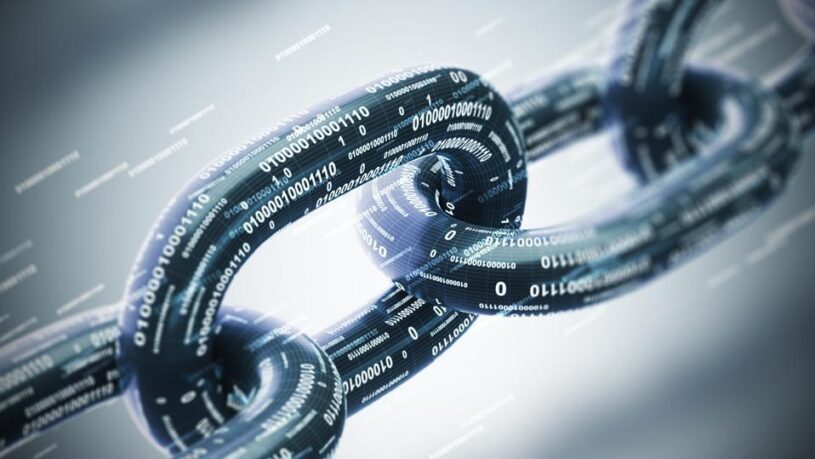

Traditionally ownership of assets, be it land or a piece of art, happened in the physical world. This meant two things: one, that the asset involved in a transaction was tangible, and two: there was no provision for fractional or partial ownership of an asset. However, the discovery of blockchain has allowed the digital ownership of assets, which allows fractional ownership of assets and intangible products.

Before the advent of blockchain technology, people invested in physical assets like land or property only if they had the money to buy the entire plot of land or the entire property that was on sale. However, with the advent of blockchain, any asset can be divided into small units in terms of digital tokens, each token denoting a particular portion of the asset.

Fractional ownership of assets has several advantages, like increased liquidity in the real estate market.

For instance, a house that costs a million dollars is an illiquid asset, simply because it is difficult to find buyers who can pay a million dollars in one go. But if the value of the house has been divided in terms of a million digital tokens, then selling and buying those tokens is fairly easy. Thus, having digital tokens increases the liquidity of expensive assets like expensive houses and plots of land.

Apart from fractional ownership of assets, blockchain also helps in the ownership of intangible assets like NFTs (non-fungible tokens). And they can be any digital art from a drawing to an animation, or a meme. However, it is built on blockchain and has a digital signature that signifies the ownership of the asset.

2. Smart Contract-Based Financial Transactions

A regular contract between two parties denotes the set of terms and conditions each party must adhere to. However, smart contracts do not contain legal jargon; instead, they have an “if-logic” logic that runs the contract. Blockchain-based smart contracts have made financial transactions free of the clutches of legal jargon and have made transactions more transparent.

A smart contract is nothing but a code that runs on an if-logic. This means that if a condition or a set of conditions are met, then the next steps of the contract will be fulfilled. One simple example is the vending machine you see in a department store.

Only when you put a dollar coin, buttons become activated, and only when you press the button for a certain product, a mechanical component fetches the product. When the product has been fetched the service window opens and the product is pushed out.

However, not all smart contracts are based on blockchain, but most decentralized smart contracts run on blockchain.

A smart contract can be of tremendous help in hastening financial transactions. They release funds to appropriate parties and send notifications to those who are supposed to receive or pay money to another party.

Smart contracts have several advantages, like fast transactions, because when a party fulfills a part of a contract, the other part is executed immediately without any third-party intervention. They also ensure the safety of the transaction because blockchain transaction records are encrypted.

3. Transactions Between Different Blockchains

It is easy to buy and sell cryptos that are based on a single blockchain. However, there are more than a hundred different types of blockchain-based cryptocurrencies that are available in the market. And it is usually difficult to transfer an asset or a coin from one blockchain type to another.

Usually, transferring coins from one blockchain to another requires tedious manual cross-chain transfers. But modern cryptocurrency-based solution providers have devised such applications that allow seamless transfer of tokens across blockchains.

4. Use Of Blockchain In Banking And Lending

Most banking and lending activities suffer from typical challenges associated with excessive centralization. However, blockchain-based decentralized solutions are making their way into banking and lending activities as well.

Blockchain-based applications allow for easy authentications of KYC (know your customer) related data. Hence, they reduce both the operational risk and the time taken to complete the verification of financial documents.

Blockchain-based solutions have also been used for automatic underwriting for the approval of loans. Underwriting means verification of a person’s income and assets before approving a loan in his name.

Physical verification of financial details for underwriting takes a lot of time; however, with the use of blockchain, the process is much faster and more efficient.

Blockchain technology is also used for facilitated collateralization of assets in the banking sector. Digitization allows real-time management of assets and helps in tracking the flow of assets.

5. Use Of Blockchain In The Insurance Sector

Like the banking sector, the insurance sector too makes use of blockchain in multiple ways. Smart contracts based on blockchain are used in the insurance sector, and they help in the quick processing of insurance claims. Decentralized systems also allow tokenized reinsurance markets to function, and they do away with brokers and other middlemen.

Conclusion

Decentralized solutions are a boon when it comes to financial transactions. They bring much-needed transparency to regulatory processes. They also increase the inclusivity of financial transactions because those who do not have a bank account or a demat account can trade in blockchain-based assets.

Smart contracts are another area where decentralized transactions are showing a sea change. These contracts have redefined contracts, enabling seamless transactions that verify all actions and act almost immediately. However, blockchain-based applications are a work in progress, and regular research is needed to develop the applications further to better serve the users’ interests.